The best stock trading app UK is designed to simplify the investment process, making it possible for anyone to buy and sell shares right from their smartphone or tablet. But with so many options available, how do you know which app is right for you? In this article, we’ll review the top stock trading apps in the UK to help you make an informed decision.

The world of stock trading has undergone a significant transformation over the years. Gone are the days when investors had to rely on traditional brokers to buy and sell shares. Today, technology has made it easier for anyone to invest in the stock market, thanks to the availability of stock trading apps.

What is a stock trading app?

A stock trading app is a mobile application that allows investors to buy and sell shares of stocks, ETFs, and other financial assets. These apps often provide real-time market data and analysis, making it easier for investors to make informed decisions about their investments.

Top 5 best stock trading apps UK:

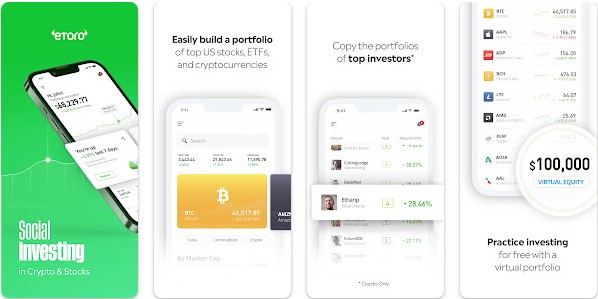

1. Best stock trading app UKeToro

eToro is a popular trading platform that has been around since 2007. It has gained a reputation as one of the most user-friendly platforms for trading stocks, commodities, currencies, and cryptocurrencies. eToro is also known for its social trading feature, which allows users to follow and copy the trades of other successful traders. Here are some of the key features and benefits of eToro:

Features:

- eToro offers commission-free trading for stocks and ETFs, which makes it an affordable option for investors.

- The platform has a wide range of stocks to choose from, including stocks from the UK, US, and other international markets.

- eToro has a user-friendly interface that is easy to navigate, even for beginners.

- The social trading feature allows users to follow and copy the trades of successful traders, which can help them learn and make informed investment decisions.

- eToro also offers a range of educational resources and tools, including a trading academy and webinars, to help users improve their trading skills.

Benefits:

- Commission-free trading: eToro does not charge any fees or commissions for trades, which can help users save money.

- Social trading: The social trading feature allows users to learn from and copy the trades of successful traders, which can help them make more informed investment decisions.

- User-friendly interface: eToro has a user-friendly interface that is easy to navigate, even for beginners.

- Educational resources: eToro offers a range of educational resources and tools, including a trading academy and webinars, to help users improve their trading skills.

FAQs:

Q: Does eToro charge any fees or commissions for trades? A: No, eToro does not charge any fees or commissions for trades. However, there may be other fees, such as withdrawal fees or inactivity fees, that users should be aware of.

Q: Can I trade stocks from international markets on eToro? A: Yes, eToro offers a wide range of stocks from international markets, including the UK, US, and other markets.

Conclusion:

eToro is a popular and user-friendly trading platform that offers commission-free trading for stocks and ETFs. It also offers a range of educational resources and tools, as well as a social trading feature that allows users to follow and copy the trades of successful traders. If you are looking for an affordable and beginner-friendly trading platform that offers a range of stocks and educational resources, eToro may be a good option for you.

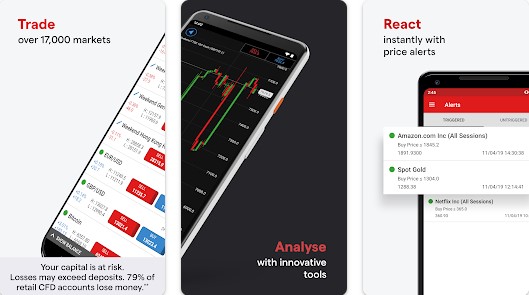

2. Best stock trading app Plus500

Plus500 is a UK-based trading platform that offers a range of instruments, including stocks, cryptocurrencies, commodities, and forex. The platform is known for its user-friendly interface and low fees, making it a popular choice among traders. Here are some of the key features and benefits of Plus500:

Features:

- Plus500 offers commission-free trading for stocks, which makes it an affordable option for investors.

- The platform has a wide range of stocks to choose from, including stocks from the UK, US, and other international markets.

- Plus500 has a user-friendly interface that is easy to navigate, even for beginners.

- The platform also offers a range of tools and features, including real-time quotes, charting tools, and risk management tools, to help traders make informed investment decisions.

Benefits:

- Commission-free trading: Plus500 does not charge any fees or commissions for trades, which can help users save money.

- User-friendly interface: Plus500 has a user-friendly interface that is easy to navigate, even for beginners.

- Range of tools and features: Plus500 offers a range of tools and features, including real-time quotes, charting tools, and risk management tools, to help traders make informed investment decisions.

FAQs:

Q: Does Plus500 charge any fees or commissions for trades? A: No, Plus500 does not charge any fees or commissions for trades. However, there may be other fees, such as overnight fees or inactivity fees, that users should be aware of.

Q: Can I trade stocks from international markets on Plus500? A: Yes, Plus500 offers a wide range of stocks from international markets, including the UK, US, and other markets.

Conclusion:

Plus500 is a popular and user-friendly trading platform that offers commission-free trading for stocks. It also offers a range of tools and features, including real-time quotes, charting tools, and risk management tools, to help traders make informed investment decisions. If you are looking for an affordable and beginner-friendly trading platform that offers a range of stocks and tools, Plus500 may be a good option for you.

3. Best stock trading app IG

IG is a UK-based trading platform that offers a range of financial instruments, including stocks, forex, and cryptocurrencies. The platform has been around since 1974 and is known for its extensive range of tools and features, making it a popular choice among both beginners and experienced traders. Here are some of the key features and benefits of IG:

Features:

- IG offers commission-free trading for stocks, which makes it an affordable option for investors.

- The platform has a wide range of stocks to choose from, including stocks from the UK, US, and other international markets.

- IG has a user-friendly interface that is easy to navigate, even for beginners.

- The platform also offers a range of tools and features, including advanced charting tools, technical analysis tools, and risk management tools, to help traders make informed investment decisions.

Benefits:

- Commission-free trading: IG does not charge any fees or commissions for trades, which can help users save money.

- User-friendly interface: IG has a user-friendly interface that is easy to navigate, even for beginners.

- Range of tools and features: IG offers a wide range of tools and features, including advanced charting tools, technical analysis tools, and risk management tools, to help traders make informed investment decisions.

FAQs:

Q: Does IG offer commission-free trading for all instruments? A: No, commission-free trading is only available for stocks on IG. Other instruments may have fees or commissions that users should be aware of.

Q: Can I trade stocks from international markets on IG? A: Yes, IG offers a wide range of stocks from international markets, including the UK, US, and other markets.

Conclusion:

IG is a popular and user-friendly trading platform that offers commission-free trading for stocks. It also offers a wide range of tools and features, including advanced charting tools, technical analysis tools, and risk management tools, to help traders make informed investment decisions. If you are looking for a comprehensive trading platform that offers a range of stocks and tools, IG may be a good option for you.

4. Best stock trading app Trading 212

Trading 212 is a UK-based trading platform that offers commission-free trading for a range of financial instruments, including stocks, ETFs, forex, and cryptocurrencies. The platform is known for its user-friendly interface, low fees, and innovative features, making it a popular choice among traders. Here are some of the key features and benefits of Trading 212:

Features:

- Commission-free trading: Trading 212 offers commission-free trading for all instruments, which can help users save money.

- User-friendly interface: Trading 212 has a user-friendly interface that is easy to navigate, even for beginners.

- Wide range of instruments: Trading 212 offers a wide range of financial instruments, including stocks, ETFs, forex, and cryptocurrencies.

- Innovative features: Trading 212 offers a range of innovative features, including the ability to create a custom portfolio, invest in fractional shares, and use an auto-invest feature to automate investment decisions.

Benefits:

- Commission-free trading: Trading 212 does not charge any fees or commissions for trades, which can help users save money.

- User-friendly interface: Trading 212 has a user-friendly interface that is easy to navigate, even for beginners.

- Wide range of instruments: Trading 212 offers a wide range of financial instruments, making it a one-stop-shop for traders.

- Innovative features: Trading 212 offers a range of innovative features that can help traders make informed investment decisions and automate their investments.

FAQs:

Q: Does Trading 212 charge any fees or commissions for trades? A: No, Trading 212 does not charge any fees or commissions for trades.

Q: Can I trade stocks from international markets on Trading 212? A: Yes, Trading 212 offers a wide range of stocks from international markets, including the UK, US, and other markets.

Conclusion:

Trading 212 is a popular and innovative trading platform that offers commission-free trading for a wide range of financial instruments. It also offers a user-friendly interface, a wide range of instruments, and innovative features that can help traders make informed investment decisions and automate their investments. If you are looking for a commission-free trading platform with a wide range of instruments and innovative features, Trading 212 may be a good option for you.

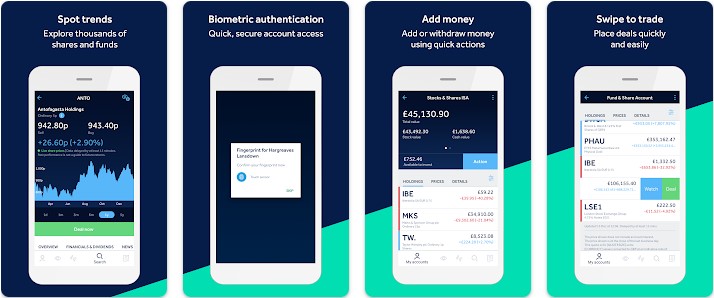

5. Best stock trading app Hargreaves Lansdown

Hargreaves Lansdown is a UK-based trading platform that offers a range of financial products and services, including stocks, funds, and pensions. The platform has been around since 1981 and is known for its high-quality research and analysis, making it a popular choice among both beginners and experienced investors. Here are some of the key features and benefits of Hargreaves Lansdown:

Features:

- High-quality research and analysis: Hargreaves Lansdown provides extensive research and analysis on a wide range of financial products, including stocks and funds. This can help investors make informed investment decisions.

- Wide range of financial products: Hargreaves Lansdown offers a wide range of financial products, including stocks, funds, pensions, and more.

- User-friendly interface: Hargreaves Lansdown has a user-friendly interface that is easy to navigate, even for beginners.

- Extensive customer support: Hargreaves Lansdown offers extensive customer support, including a 24/7 helpline and live chat support.

Benefits:

- High-quality research and analysis: Hargreaves Lansdown provides extensive research and analysis on a wide range of financial products, which can help investors make informed investment decisions.

- Wide range of financial products: Hargreaves Lansdown offers a wide range of financial products, making it a one-stop-shop for investors.

- User-friendly interface: Hargreaves Lansdown has a user-friendly interface that is easy to navigate, even for beginners.

- Extensive customer support: Hargreaves Lansdown offers extensive customer support, which can help users resolve any issues quickly and easily.

FAQs:

Q: Does Hargreaves Lansdown offer commission-free trading? A: No, Hargreaves Lansdown charges fees for trading, but the fees are relatively low compared to other platforms.

Q: Can I trade stocks from international markets on Hargreaves Lansdown? A: Yes, Hargreaves Lansdown offers a wide range of stocks from international markets, including the UK, US, and other markets.

Conclusion:

Hargreaves Lansdown is a popular and reliable trading platform that offers a wide range of financial products and services. It is known for its high-quality research and analysis, extensive customer support, and user-friendly interface, making it a popular choice among investors. If you are looking for a reliable and comprehensive trading platform, Hargreaves Lansdown may be a good option for you.

Features to consider when choosing a stock trading app:

When choosing a stock trading app, there are several features to consider. These include:

- User Interface – A good stock trading app should have a user-friendly interface that is easy to navigate.

- Market Data and Analysis – The app should provide access to real-time market data and analysis, as well as news and research tools.

- Security – The app should have robust security features to protect your investments and personal data.

- Fees – You should consider the fees charged by the app, including commissions, spread, and any other charges.

FAQs about stock trading apps:

Q: Can I trade stocks using my smartphone? A: Yes, most stock trading apps allow you to buy and sell stocks right from your smartphone or tablet.

Q: Do I need to be an experienced investor to use a stock trading app? A: No,

Q: Are these stock trading apps safe to use? A: Yes, all the apps mentioned in this article are safe to use, as they are regulated by financial authorities.

Q: Can I invest in international stocks using these apps? A: Yes, most of these apps offer access to international stocks, which means you can invest in stocks from around the world.

Q:Can I invest in stocks using these apps without any prior experience? A: Yes, many of these apps are beginner-friendly and offer a user-friendly interface that is easy to navigate. They also offer educational resources and tools that can help beginners learn about investing and make informed investment decisions.

Q: Do these apps charge any fees or commissions? A: Yes, some of these apps may charge fees or commissions for trades, but they are generally competitive and lower than traditional brokers.

Conclusion:

Investing in the stock market can be a great way to build wealth over time, and the rise of technology has made it easier than ever to invest in stocks using your smartphone or tablet. The UK market offers a range of options when it comes to stock trading apps, and choosing the right one can be a daunting task. In this article, we have discussed the top 5 best stock trading app UK, which are eToro, Plus500, IG Trading, Hargreaves Lansdown, and Trading 212. These apps offer a range of features and benefits, and choosing the right one depends on your investment goals and preferences. Make sure to research each app carefully before making a decision, and consider factors such as fees, features, and user reviews to ensure that you make an informed decision.

Atechguide Online Banking & Android App

Atechguide Online Banking & Android App