Apps like beforepay Australia allow you to borrow a percentage of your income when you need it, rather than wait for your payday to arrive. Pay-on-call for offerings are the brand new non-public monetary fashion taking up Australia. They assist you to get entry to your pay early if you have a pressing monetary want or emergency.

Apps like beforepay Australia, are they right for you? To help you make informed financial decisions, we’ll explore how programs like Beforepay Australia work, how much they’ll cost you, their key features and the pros and cons.

There are a lot of apps like Beforepay in Australia. Some have features that are similar to Beforepay, while others have unique features that might be more useful. Beforepay is the best option because you can get everything you need with it.

In this post, I’ll list out all the top Before pay alternatives for Australia that you can use as cash advances before your payday. These apps can be a lifesaver for many people, so it’s important that we always keep you updated with the list.

How do apps like Beforepay Australia work?

Programs like Beforepay Australia are paid programs that give you access to a portion of your earned salary before payday if you have a steady income. You can borrow up to $750 or $1,000 from your next paycheck before you receive it. They offer immediate financial assistance if you are facing financial problems and need money now.

If you meet the requirements, apps like Beforepay Australia will pay you a fixed amount sent directly to your bank account. You can spend it however you want and pay it back on the day you receive it via automatic debit. When you receive your paycheck or income, lenders automatically deduct the down payment and fee from your account.

Usually, programs like Beforepay Australia offer you money to cover small amounts.

You can only borrow a certain percentage of your income, usually 25%, and pay it back in a week or two. With easy access and no restrictions, you can easily get caught up in the pay-as-you-go, where you’re always looking for advance payments to survive payday because the sign-up fees have reduced your total income.

How much does it cost to borrow with apps like Beforepay Australia?

Some apps like Beforepay Australia have additional fees attached to the amount you borrow. These fees might include service and establishment fees or administrative costs. However, you might not have to pay any interest on the money you borrow.

Before you open an account, it’s important to read the terms and conditions carefully to see what fees are charged. Most banks charge a fixed 5% fee on all loans, so you’ll have to pay an additional $5 on top of the borrowed amount.

Beforepay Australia can charge you a flat fee for borrowing money. For example, you might pay $5 for all advances, or $5 for a particular range like $100 to $400. And you might have to pay 10 cents for advances that are more than $100.

App fees can add up over time, so be sure to consider how they will affect your budget before borrowing with Beforepay Australia.

Pros And Cons Of Apps Like Beforepay Australia

Pros

- • Limited dedication because you pay off the mortgage inside some weeks.

- • Convenient get entry to to short-time period coins with little hassle.

- • No hobby rate.

- • No overdue costs however you could’t re-get entry to the provider till you clean any extraordinary balances.

Cons

- • They function small loans, and you’re confined on the quantity you could borrow primarily based totally to your income. This can regularly defeat the cause of the mortgage if you could’t borrow sufficient to pay for what you need. Payday loans provide better quantities of up to $5,000. Ensure you don’t signal a mortgage settlement earlier than you’re positive of the quantity you’re getting.

- • Short time limits of much less than a month imply you won’t have a lot time to pay off the mortgage with apps like Beforepay Australia. You need to make sure you could manage to pay for to pay off on time.

- • You can wait up to 2 commercial enterprise days to get funded, which may be irritating when you have an pressing monetary need.

- • Apps like Beforepay Australia have an overdraw risk. Automatic debit is installation to your account to deduct the quantity you owe on a particular date. You may also incur extra costs from the financial institution if the price is rejected, and the account can be overdrawn if accepted, ensuing in extra charges from the financial institution.

- • You can without problems get into debt cycles with apps like Beforepay Australia. You may also locate it difficult to manage to pay for your costs on the quit of the month after having access to quantities of your paycheck in boost. Paying payments may be complex as each penny receives deducted, and you could emerge as residing from one coins boost to the next.

How To Apply For Apps Like Beforepay Australia?

Applying for apps like Beforepay Australia is straightforward. Download the app and set up it. Create a brand new account, configure your profile and offer your financial institution account details. Apps like Beforepay Australia will then set up a steady reference to your financial institution account.

Artificial intelligence will then examine your banking transactions to decide while your pay typically arrives and the development quantity you could manage to pay for. You can then pick the quantity you need, supplied it’s inside your coins-out limit, and observe the supplied instructions. If you qualify and might manage to pay for the mortgage, your boost could be accredited and transferred into your account.

Best 10 apps like Beforepay in Australia

There are many Beforepay alternatives in Australia that can give you cash advances of up to $5,000, but not all of them are approved quickly and reliably.

If you are a salaried employee and need apps like Before Pay to get a cash advance, here are the top 10 loan apps like Before Pay.

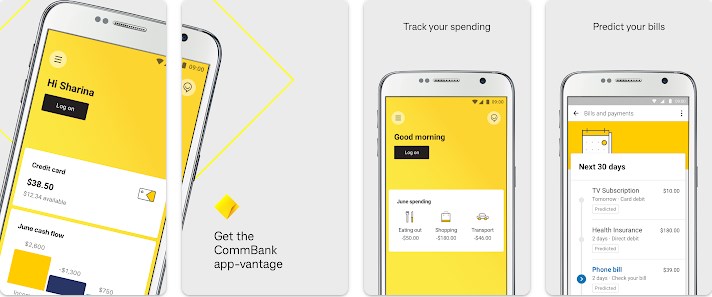

1. CommBank AdvancePay

CommBank AdvancePay is some other dependable and depended on mortgage apps like Beforepay that permits you to take out a coins increase mortgage to pay for any emergency earlier than your subsequent payday. This organisation has been in life for an extended and has quite a few fulfillment tales at the internet.

With CommBank AdvancePay, you may take a minimal mortgage of approximately $three hundred to any quantity earlier than your subsequent payday. This mortgage might have a single $five price for every $500 you are taking. That approach you may pay a $five price for $500 and $10 for $501-$one thousand, etc.

However, in case you default to pay off your mortgage, you is probably penalized and different costs implemented for your account. But it’s far one of the nice options to the Beforepay mortgage app.

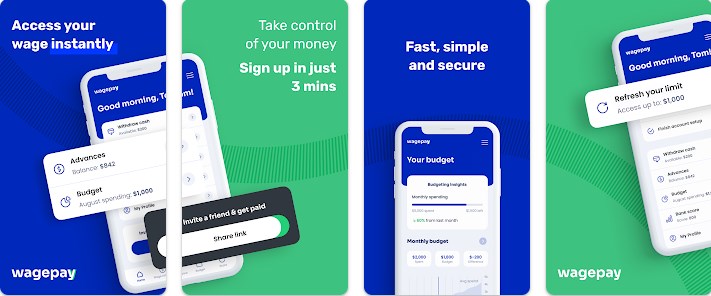

2. WagePay Loan App

Apps like beforepay WagePay much like the call implies is one of the nice mortgage apps like BeforePay. The app facilitates you are taking a coins increase mortgage of as much as 25% of your modern-day wages and pay off lower back with a tiny one-time greater price of approximately five% of the whole mortgage quantity.

This app but isn’t always as not unusualplace as CommBank AdvancePay and Latitude because of the fast length it’d permit you however it’s far one of the lifesaving apps you may take out a brief coins mortgage speedy and pay off lower back to your subsequent payday with minimum hobby rates.

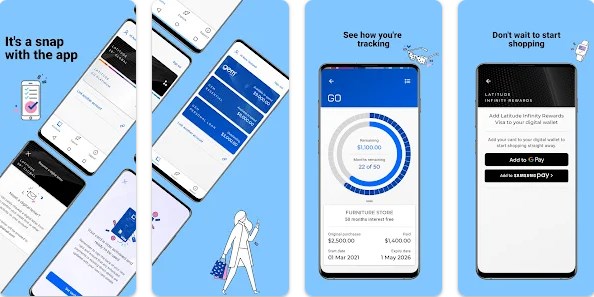

3. Latitude

Apps like beforepay Latitude is one of the nice mortgage apps like Beforepay that operates in a comparable way. Although this app is owned via way of means of a organisation referred to as Latitude Financial Services is devoted to providing any type of mortgage to clients. However, it has a devoted function this is referred to as LatitudePay that also can be used to pay for services and products earlier than your subsequent payday with none shape of hobby rate.

The reimbursement choice works in a way much like getting a credit score card out of your financial institution however works on on line and eCommerce web sites perfectly.

4. Mypayfast App

While that is additionally one of the correct mortgage apps like Beforepay, it’s far a bit bit strict for low-profits earners and operates in a barely exceptional way from WagePay and Latitude. You’ll want to attach your financial institution with the app which mechanically detects if there may be a regular influx withinside the account.

Mypayfast facilitates you tune all of your profits and prices and whilst the want arises so one can take a coins increase mortgage, it offers you get entry to to a part of your finances even earlier than the day you may receives a commission. The app won’t give you the results you want in case you don’t have a weekly influx of $480 or greater.

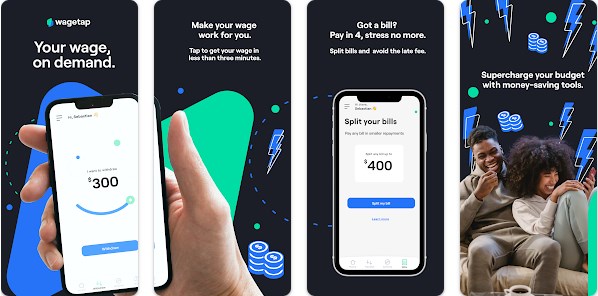

5. Wagetap

Digital Services Australia V Pty Ltd based Wagetap mortgage app. It is one of the nice Beforepay opportunity accessible to take a mortgage.

As one of the apps like Beforepay, it really works much like Wagepay. Just that the most of your salary that this app can provide is $three hundred at the same time as this is only a place to begin for Wagepay.

6. Payactiv

Payactiv is some other exciting mortgage app to get entry to your earned wages on time even days earlier than your real Payday. You can receives a commission in advance of your income earlier than getting paid via way of means of your organisation. Even businesses can sign on and provide those possibilities to their employees.

As one of the nice mortgage apps like Beforepay, you don’t want a lot to be qualified. The organisation has been on line for the reason that 2012 and has garnered quite a few fine comments from clients they have got served.

7. PressPay

PressPay additionally pinnacle our listing at the nice apps like Beforepay. It one of the handiest and higher choice as compared to different options. This app has been saving many and might provide you as much as $one thousand at the same time as it’s far mechanically deducted out of your subsequent payday.

This app best require your cellular range and your account might be setup at the same time as you hyperlink your financial institution account with it for automated deposit and deductions to your subsequent payday.

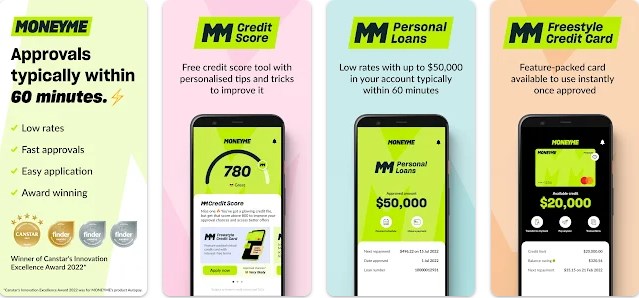

8. MoneyMe

MoneyMe additionally works in a comparable manner with BeforePay however greater of a mortgage app than a earlier than pay app. This mortgage app isn’t pretty clean what it’s far providing to clients.

9. Cash Converters

Cash Converters has been round for every now and then and nevertheless feature in a comparable manner and might provide $50-$2000 in coins increase to your subsequent reimbursement. This mortgage also can be received in shop or on line.

10. ZayZoon

ZayZoon despite the fact that now no longer too famous has been verified to provide subsequent payday mortgage possibilities to employees. The app is incorporated with quite a few Payroll machine and businesses can combine it with their answers too.

Get More Apps and News for Your Smartphone Here

Atechguide Online Banking & Android App

Atechguide Online Banking & Android App