Best Budgeting Apps

Best budgeting apps are tools that can help individuals manage their personal finances. They allow users to track their income and expenses, set financial goals, and monitor their progress towards those goals. In today’s world, where financial management is crucial for achieving financial stability and success, best budgeting apps have become increasingly popular.

This article aims to provide a comprehensive list of the top 10 best budgeting apps for iPhone and Android in 2023. The list will include both free and paid options, and will be evaluated based on specific criteria. The MECE (Mutually Exclusive, Collectively Exhaustive) framework will be used to ensure that the list is comprehensive and unbiased.

The MECE framework is a structured problem-solving approach that involves breaking down a problem into mutually exclusive and collectively exhaustive categories. In the context of this article, it will be used to ensure that the selection of best budgeting apps is comprehensive and covers all possible options. By using this framework, we aim to provide our readers with a comprehensive and unbiased list of best budgeting apps to choose from.

How Budgeting Apps Can Help You Achieve Your Financial Goals

- They can help you track your expenses: Best budgeting apps can help you track your expenses and identify areas where you’re overspending. By keeping track of your spending, you can make better decisions about where to cut back and save money.

- They can help you create a budget: Creating a budget is an essential step in managing your money. Best budgeting apps can help you create a budget that works for your income and expenses. With a budget in place, you’ll have a better understanding of where your money is going and how much you can save each month.

- They can help you save money: Many budgeting apps have built-in features that help you save money. For example, some apps can analyze your spending and recommend ways to save money on your bills, such as by switching to a cheaper energy provider or canceling subscriptions you’re not using.

- They can help you set financial goals: Setting financial goals is an important step in achieving financial success. Best budgeting apps can help you set realistic goals and track your progress towards achieving them. Whether you’re saving for a down payment on a house or paying off debt, budgeting apps can help you stay on track.

- They can help you avoid debt: One of the most significant benefits of using best budgeting apps is that they can help you avoid debt. By tracking your spending and creating a budget, you can ensure that you’re living within your means and not relying on credit to make ends meet.

Criteria for Selecting the Best Budgeting Apps

To ensure that our list of the top 10 best budgeting apps is comprehensive and unbiased, we will use the MECE (Mutually Exclusive, Collectively Exhaustive) framework. This framework involves breaking down the selection criteria into mutually exclusive and collectively exhaustive categories. By doing so, we can evaluate each app based on specific criteria and ensure that the list is balanced and covers all possible options.

The criteria for evaluating the best budgeting apps will include, but not be limited to:

- User Interface: The user interface of the app should be intuitive, easy to navigate, and visually appealing.

- Features: The app should have a range of features to help users manage their finances, such as expense tracking, goal setting, and budgeting tools.

- Pricing: The app should offer affordable pricing options, and any premium features should be worth the investment.

- Customer Support: The app should have reliable customer support options to help users with any issues or questions.

It is also important to balance the list with both free and paid options. While there are many free budgeting apps available, some paid options offer additional features and functionality that may be worth the investment. By including both free and paid options, we aim to provide a comprehensive list that caters to a range of needs and preferences.

How to Choose the Best Budgeting Apps

Here are some additional tips on how to choose the best budgeting apps for your needs:

- Consider your financial goals Before choosing best budgeting apps, consider what you want to achieve financially. Do you want to save for a down payment on a house? Or pay off your student loans? Different budgeting apps offer different features that can help you achieve your goals.

- Look for an app that suits your lifestyle Some budgeting apps require you to manually enter your expenses, while others automatically track your expenses by linking your accounts. Consider which option works best for your lifestyle.

- Check the app’s security features Since budgeting apps require access to your financial information, it’s important to check the app’s security features. Look for apps that use two-factor authentication, encryption, and other security measures to protect your information.

- Read user reviews Reading user reviews can help you get an idea of how well the app works and what its strengths and weaknesses are. Look for reviews from users who have similar financial goals and lifestyles as you.

- Consider the app’s cost While some budgeting apps are free, others require a monthly or yearly subscription fee. Consider whether the cost is worth it based on the features the app offers and how well it helps you achieve your financial goals.

By considering these factors, you can choose the best budgeting apps for your needs and start taking control of your finances today.

Top 5 Free Best Budgeting Apps

The following are our top 5 picks for free budgeting apps for iPhone and Android.

1: Mint

Mint is a popular and highly rated budgeting app that offers a range of features, including expense tracking, bill payment reminders, and personalized budgeting tools. The app’s user interface is intuitive and easy to navigate, with customizable categories and alerts. Mint is completely free to use, with no hidden fees or charges. However, some users have reported issues with syncing their accounts and updating transactions.

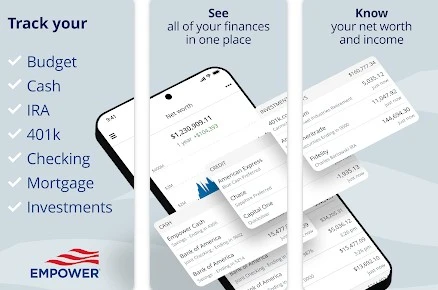

2: Personal Capital

Personal Capital is a free best budgeting app that offers both budgeting tools and investment tracking features. The app’s user interface is visually appealing and easy to navigate, with customizable categories and charts. Personal Capital offers a range of tools to help users manage their investments and plan for retirement. However, some users have reported issues with syncing their accounts and the app’s customer support.

3: PocketGuard

PocketGuard is a free best budgeting app that offers expense tracking and budgeting tools. The app’s user interface is simple and intuitive, with a clear overview of spending and saving goals. PocketGuard offers a range of features to help users save money, including alerts for bill payments and savings goals. However, some users have reported issues with syncing their accounts and the app’s customer support.

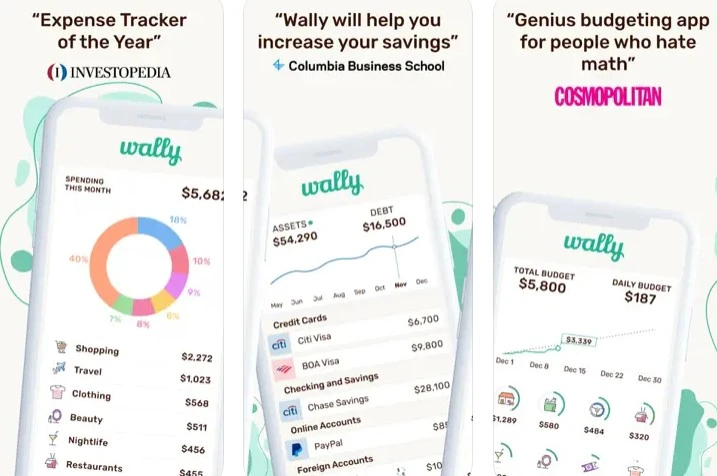

4: Wally

Wally is a free best budgeting app that offers expense tracking and budgeting tools. The app’s user interface is sleek and visually appealing, with customizable categories and a clear overview of spending. Wally also offers features like bill payment reminders and savings goals. However, some users have reported issues with syncing their accounts and updating transactions.

5: Clarity Money

Clarity Money is a free best budgeting app that offers expense tracking, bill payment reminders, and personalized budgeting tools. The app’s user interface is easy to use, with a clear overview of spending and saving goals. Clarity Money also offers a range of features to help users save money, including alerts for recurring charges and subscription cancellations. However, some users have reported issues with syncing their accounts and the app’s customer support.

Top 5 Paid Best Budgeting Apps

The following are our top 5 picks for paid best budgeting apps for iPhone and Android.

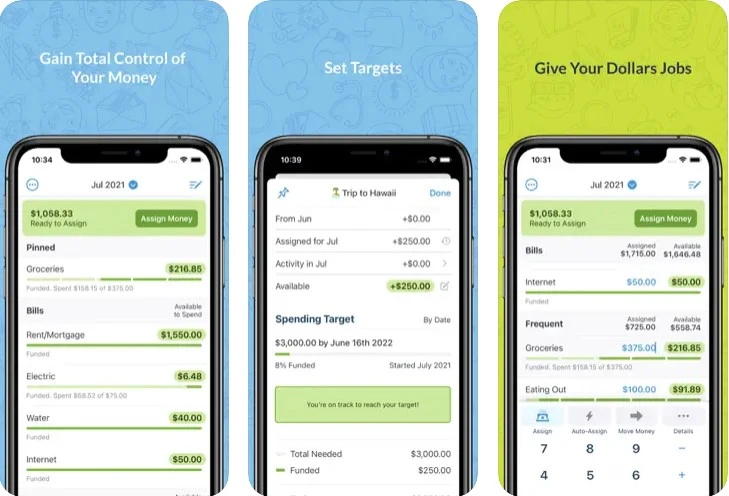

6: YNAB (You Need A Budget)

YNAB is a paid best budgeting app that offers a range of features, including expense tracking, budgeting tools, and personalized coaching. The app’s user interface is intuitive and easy to navigate, with customizable categories and alerts. YNAB offers a free trial for 34 days, after which it costs $11.99/month or $84/year. The app’s personalized coaching and community support are standout features, but some users may find the cost prohibitive.

7: PocketSmith

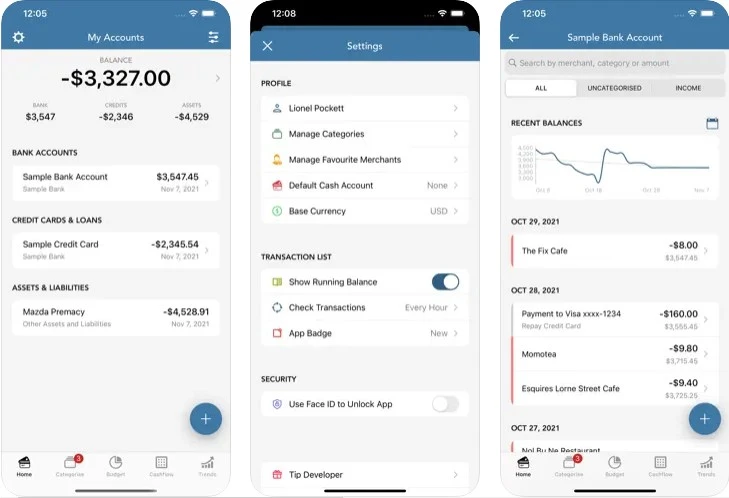

PocketSmith is a paid best budgeting app that offers expense tracking, budgeting tools, and investment tracking features. The app’s user interface is visually appealing and easy to navigate, with customizable categories and charts. PocketSmith offers a range of tools to help users manage their investments and plan for retirement. PocketSmith offers a free version with limited features, but the premium version costs $9.95/month or $89/year. Some users have reported issues with syncing their accounts and the app’s customer support.

8: Goodbudget

Goodbudget is a paid best budgeting app that uses the envelope budgeting method to help users manage their money. The app’s user interface is simple and intuitive, with customizable categories and alerts. Goodbudget offers a free version with limited features, but the premium version costs $6/month or $50/year. The app’s envelope budgeting method is a standout feature, but some users may find it too restrictive.

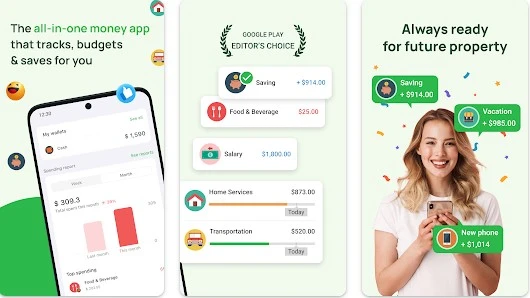

9: Money Lover

Money Lover is a paid best budgeting app that offers expense tracking, budgeting tools, and investment tracking features. The app’s user interface is visually appealing and easy to navigate, with customizable categories and charts. Money Lover offers a range of tools to help users manage their investments and plan for retirement. Money Lover offers a free version with limited features, but the premium version costs $4.99/month or $19.99/year. Some users have reported issues with syncing their accounts and the app’s customer support.

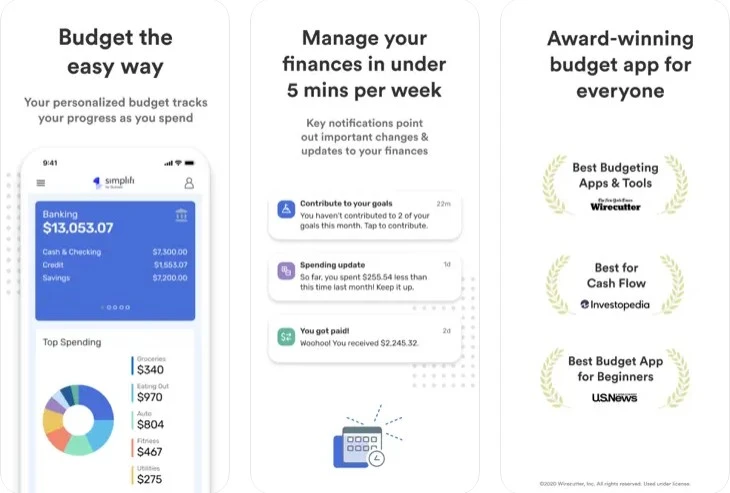

10: Simplifi by Quicken

Simplifi by Quicken is a paid best budgeting app that offers a range of features, including expense tracking, budgeting tools, and personalized coaching. The app’s user interface is intuitive and easy to navigate, with customizable categories and alerts. Simplifi offers a free trial for 30 days, after which it costs $3.99/month or $39.99/year. The app’s personalized coaching and community support are standout features, but some users may find the cost prohibitive.

Conclusion

In conclusion, best budgeting apps are an essential tool for managing your finances, and there are plenty of options to choose from on both iPhone and Android. We have compiled a list of the top 10 budgeting apps, including five free options and five paid options, that meet our criteria for features, user interface, pricing, pros, and cons.

When selecting the best budgeting app, it’s essential to consider your individual needs and preferences. For example, if you prefer a simple budgeting method, Goodbudget may be the best option for you, whereas if you need personalized coaching and community support, YNAB may be the better choice.

As technology continues to advance, we can expect future developments in budgeting app technology, such as more advanced artificial intelligence, increased integration with other financial apps, and enhanced security features.

Ultimately, by choosing the right best budgeting app for your needs, you can take control of your finances, save money, and achieve your financial goals.

Atechguide Online Banking & Android App

Atechguide Online Banking & Android App